Financial Literacy Month – How to Set Financial Goals

Posted on: November 19, 2019Posted in Budgeting, Financial Advice | Comments Off on Financial Literacy Month – How to Set Financial Goals

Another focus of this year’s Financial Literacy Month is to help Canadians learn how to set financial goals. It’s just basically figuring out three important things –

- Where your money should go,

- What you want it to do, and

- What you are saving it for.

It’s a critical step to becoming financially literate for these reasons:

- It will help you to set your own priorities for your money.

- It will help you work toward something specific.

- It will help you get into the habit of saving to achieve your goals.

- It will help you decide exactly what you think you should do with your money so you can make the most of it.

If you don’t have solid financial goals, you may tend to lose direction and are likely to spend more than you should and end up in debt, or if you have savings, it might end up floating in limbo when your money could be put to good use. On the other hand, if you have a financial plan, you’re far more likely to pay bills on time, to have an emergency fund, to have savings and investment and are more likely to feel financially stable.

Types of Financial Goals

Some goals are more pressing than others, like down payments, paying credit card debt and setting up emergency savings. Other goals are vital, such as saving for retirement. You can set short-term, mid-term, and long-term financial goals, it doesn’t matter, what matters is to get started right away so you can maximize every penny you have.

Here are some good goals you might want to consider setting for your own financial well-being:

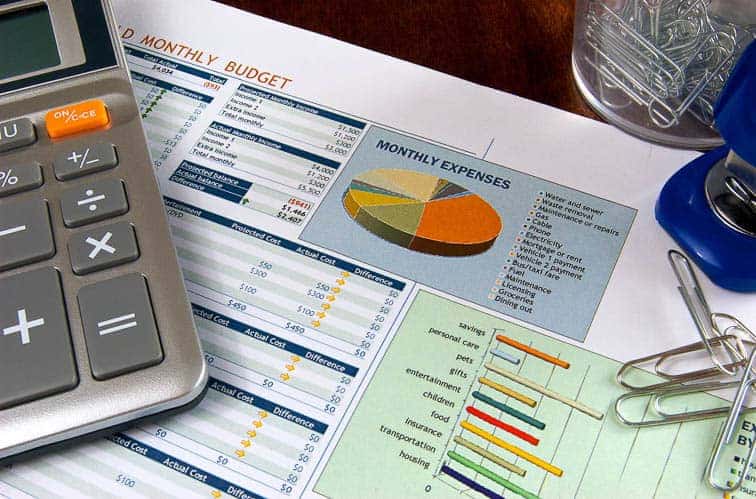

Set a budget plan

Setting a budget is a very common financial goal because, really, it is the most basic step you can take to get control of your financial future. A budget will help you clearly define the amount of income you have and where you are spending your money on. It will then help you see any expense that is stopping you from reaching your goals. If you diligently live by a budget, you can stop spending too much, you can stop going into debt and you can start saving.

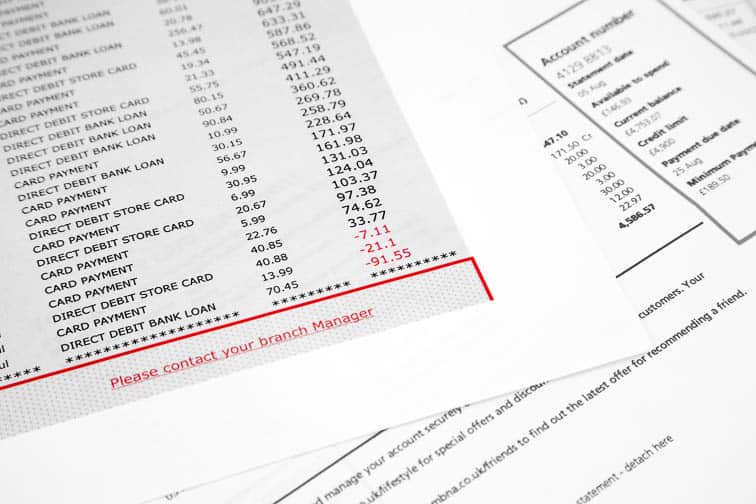

Paying off credit card debt

If you have high-interest credit card debt, getting rid of it should be a top priority. You can use the snowball method, the avalanche method, do a transfer balance, try credit consolidation with a reputable company, whatever debt elimination strategy you can afford to do, the main goal should be to pay that debt off first and as soon as possible. Credit card debt can hinder your ability to build wealth and reach your financial goals if you are not proactive. The high-interest rates eat up so much of your cash flow that could be used for other objectives instead of interest payments, so you need to tackle the debt first so you can move forward.

Saving for an emergency fund

Having an emergency fund is like having some financial assurance that you have some cash stash away that you can easily use to help you deal with life’s rainy days easier. Whether it’s an unexpected home or car repair, or an unplanned visit to the doctor or dentist, your emergency fund is essential to help cover costs that you don’t plan to happen.

33% of Canadians feel that they don’t have the financial resources to handle an unforeseen event, so if you’re feeling the same concerns, take some solid steps right away to build an emergency fund that will help you have some peace of mind, knowing you can cope with unforeseen bills and expenses.

The general rule is to have enough funds to cover up to six months of your living expenses. Start building your savings in small steps with what you can actually afford to set aside right now. That’s a good start, and be consistent and in time you will see your funds grow.

Saving for retirement

Saving for retirement is another top-rated financial goal. One of the topmost concerns about retirement is if you will have enough to live on. The key is to plan for an early retirement, this way you’ll still have plenty of time to make it even if you hit a few snags before the legal retirement age of 65.

You need to consider two critical points when you’re planning for retirement:

- Make sure you are able to retire without loads of debt, and

- You have a reasonable income stream that you can live off of.

A long-term approach of disciplined saving and investing can help you attain this goal.

Many of us don’t bother to set financial goals. We choose to rely on luck and, well, come what may. However, setting financial goals can help influence the way we manage money and can greatly increase the likelihood of our financial success. With goals set up, we are able to better meet savings needs, we are able to control our spending, we are able to make wise buying decisions and use credit responsibly and avoid going into debt – all because there is a plan, a clear and solid direction and intention of where our money should go.