Getting a Secured Credit Card to Restore Your Credit Rating

If you’ve recently filed bankruptcy or a consumer proposal, a secured credit card is a way to help you rebuild your credit rating and develop a stronger financial future. It’s not a fast track way to build credit or improve your score, but it’s a clear and simple step that can get you there over time.

A consumer proposal and bankruptcy are effective debt relief solutions that offer immediate relief from overwhelming debt as well as legal protection from creditors. However, they do have a negative impact on your credit score. In general, once you file a consumer proposal, you will have an R7 rating whereas declaring bankruptcy will give you an R9 rating – both very low scores as measured on a scale of R1 to R9 by the credit bureaus. Moreover, these low ratings will remain on your credit profile for three years from the date of a consumer proposal is fulfilled and for six years from the date of discharge from a bankruptcy.

How to rebuild after a Bankruptcy or Consumer Proposal

Although a low rating will stay on your profile for a few years, you don’t have to wait that long to rehabilitate your credit. You can begin immediately and start credit after a bankruptcy or consumer proposal by getting a new mortgage, car loan, credit card, bank loan, etc. In other words apply for some credit. It doesn’t have to be much. The point is to show you can handle the credit you get. In as little as two to three years you can re-establish credit and may even have a better credit rating than before you started!

Among the most crucial factors in rebuilding credit is developing a positive payment history and managing finances responsibly. You need to be able to demonstrate to lenders that you can pay back the money you borrowed on time consistently and prove that you can responsibly manage debt.

Credit behaviour matters as it reflects your track record of making timely payments on your loans and credit cards. Discipline is key as consistently paying on time demonstrates financial responsibility and can boost your score. Keeping a balanced credit utilisation ratio is also advisable for a positive impact. A good rule of thumb for credit usage is to never exceed 30% of your total available credit limit.

Working to rebuild your credit can feel nearly as daunting as getting out of debt, but with the right process and a clear sense of direction and commitment, you can get where you want to go. The most crucial factor is to carefully consider options and pick the right path. Not all paths to rebuilding your credit will suit your unique financial situation and goals.

How can I use a secured credit card to rebuild credit

A secured credit card is a great choice for someone looking to build or improve your credit history. If you use them responsibly, secured credit cards can help you increase your score over time. Many licensed insolvency trustees, debt counsellors and other financial professionals often suggest using a secured credit card to rebuild credit.

Secured credit cards are a special type of card typically designed for those who are looking to rebuild their credit. These cards are more accessible for people who have low credit scores.

A secured credit card requires a cash deposit from the cardholder. This deposit acts as collateral for transactions. In case you can’t make payments, the lender can use the deposit to pay the debt. The credit limit for the credit card is equal to the amount that you put down as deposit.

Use a secured debit card similar to how you would use a debit card, keeping in mind that you’re using your own money every time you make a purchase, rather than borrowing funds from a lender.

The key to building credit with a secured credit card is to practice three essential habits.

- Use your secured credit card wisely – Make sure to use the card each month for one or two small purchases without overspending or missing payments.

- Keep your balances low – Avoid maxing out your credit card and try to keep your balance low and aim to maintain your credit utilization below 30 percent ideally.

- Pay off your debts like clockwork – Show responsible credit habits by always paying your balance on time and in full every month.

Keep in mind that the goal is to demonstrate responsible credit use to increase your credit opportunities in the future.

Choosing the right secured credit card

One factor to help you build really strong credit is making sure you choose the right secured credit card that will meet your needs. These features are essential to ensure the card you use is a helpful tool for building and improving credit.

- Choose a card that reports to credit bureaus. Make sure you ask whether the issuer reports your repayment behaviour to Canada’s credit bureaus: TransUnion, Experian, or Equifax. Not all secured credit cards will do this, which defeats the purpose of opening an account. A prepaid credit card doesn’t usually report at all. If reporting is not available, look for a different secured credit card or another credit card option suitable for bad credit.

- Choose a card that requires a reasonable security deposit. In Canada, secured credit cards typically require deposits of $200 to $500 and can be as high as $10,000. There are also many secured cards that allow you to put down even less collateral, as low as $49 to start. Keep in mind that the cash deposit will not be accessible unless you close your account, so choose what you can afford to pay. A card with a low minimum required amount will work if you’re short on cash. A secured card with a higher deposit can help improve your credit utilization ratio and potentially boost your credit score faster, but it can also increase the temptation to overspend.

- Choose a secured card that doesn’t have outrageous fees. Watch out for large monthly or annual fees that can deplete your deposit. It’s also important to consider other helpful benefits, such as an opportunity to increase your credit line, an offer to upgrade to an unsecured credit card or refund your deposit if you can show that you manage your line of credit responsibly and make a series of payments on time.

If used strategically, a secured credit card can be a helpful tool for building and improving credit after bankruptcy or a consumer proposal. The right secured credit card can help you obtain new credit and re-establish a good payment history.

Talk to a Licensed Insolvency Trustee such as Richard Killen & Associates Ltd. about getting a secured credit card after bankruptcy or consumer proposal and get helpful strategies that can effectively repair your credit rating and help you avoid racking up new debt.

CAIRP Press Release

Fewer Canadians seeking debt relief during COVID crisis, those struggling urged to seek help from licensed professionals.

According to a press release by the Canadian Association of Insolvency and Restructuring Professionals (CAIRP) they suggest that many people who should be seeking the services of a Licensed Insolvency Trustee are not. It seems that between government relief programs and creditors offering payment deferrals many do not feel the urgency to deal with their debt problems. Read the release below.

TORONTO – May 11, 2020 – After consistently climbing higher over the last year, the number of Canadians who filed for insolvency in the first quarter of 2020 was down 5.5 per cent compared to the previous quarter, according to the latest official figures released today. In March alone consumer insolvencies decreased by 8.5 per cent compared to the same time last year.

The decline is largely the result of increased payment flexibility among creditors, landlords and administrators coupled with temporary income supports provided by the government. While these measures have allowed many to make ends meet, bankruptcy professionals agree that consumer insolvencies will spike in the wake of the coronavirus pandemic.

“For those who were already overstretched with more debt than they could reasonably afford, the government relief and short-term payment reprieve have allowed many to stay afloat. But their underlying debt is a gaping hole in the lifeboat,” says Mark Rosen, Chair of the Canadian Association of Insolvency and Restructuring Professionals (CAIRP). “The pandemic will magnify the debt problems Canadians were already facing and insolvency will be the way out for many.”

Prior to the widespread income shock and economic uncertainty brought on by COVID, consumer insolvencies were already on the rise in Canada. In spite of the dip in the first quarter, the total number of insolvencies for the 12-month period ending March 31 increased by 8.4 per cent compared to the same period last year.

With no clear end to the pandemic in sight, Rosen says that severely indebted Canadians should seek professional advice now from Licensed Insolvency Trustees before they find themselves even more in over their heads.

Licensed Insolvency Trustees are federally regulated debt professionals who can offer guidance regarding all of the debt-relief options available to Canadians. With solid accounting expertise and extensive knowledge of governing legislation, they are empowered to provide protection from creditors and can discharge people from debt. They take a customized approach to determine which restructuring option is most suitable based on individual circumstances.

If it is determined that bankruptcy or proposal is the best course of action, the dual role of the Licensed Insolvency Trustee is to ensure that the debtors’ rights are not abused while protecting the rights of creditors.

“For individuals and families in financial distress, the insolvency process is really about moving forward after hardship to focus on a brighter future. For creditors, the process formalizes negotiations and cushions losses,” says André Bolduc, executive board member of (CAIRP) and Licensed Insolvency Trustee.

He points out that as soon as an individual files for insolvency, they are protected from creditors, which can also include protection from collection agency calls and wage garnishment.

“It’s so easy to become paralyzed with fear or shame and let the bills pile up even more but that is the absolute worst thing you can do right now. You do not need to tough out this crisis on your own. Help is available,” adds Bolduc.

In an effort to maintain social distancing measures while continuing to support those in need of financial assistance, many Licensed Insolvency Trustees across the country are providing free contactless consultations virtually or by phone.

You may read the press release here.

If you are in debt, we are here to help you with a debt solution whether it be a consumer proposal or a bankruptcy. Talk to us. We offer a free consultation by phone or by video chat. Call us at 1-888-545-5365

Richard Killen’s Christmas Message 2019

December is a very exciting and interesting time of year. From the official beginning of Winter to the various religious celebrations, such as Christmas and Hanukkah. It’s also a time for some philosophical pondering; reviewing the year past and formulating our resolutions for the coming year. Yes, December can be a very important month. It certainly is a good time to appreciate all the good things we are given, especially when they occur through no effort of our own.

True, not everything that happens to us is positive and easy to take. Everyone has the challenge of dealing with negative things like health problems and all the other personal trials life throws at us. Sometimes it feels like that’s all there is. But it isn’t, is it?

In the book I wrote, The Glass Is Half Full, I try to make the point that no matter how difficult our problems and challenges, the attitude with which we face them goes a long way to getting us through it and even turning these things around. Most importantly, we cannot let the bade things that happen to us define how we see ourselves.

I can’t think of a more valuable way to wind up the year. Maybe that’s why Christmas and Hanukkah take place at this time. For thousands of years these religious celebrations, and their cousins in other faiths, remind us of all the positive gifts life provides and how we should never take any of it for granted. They also encourage us to believe that facing up to our daily toil and turmoil courageously pays off for us in the end. That’s something we owe to ourselves and to those we love.

So with that thought, I’ll which all of you a very Merry Christmas and Happy Hanukkah and hope that you and yours are blessed with good health and happiness throughout 2020.

What Too Much Debt Looks Like In The Greater Toronto Area

According to Statistics Canada, Canadian families now roughly owe $1.78 for every $1 they earn. These debts include consumer credit, mortgage and non-mortgage loans. Yes, we’ve got too much debt and piled up credit card charges for home renovations and eating out, for long-term car loans to buy up new vehicles, and not to mention those home equity lines of credit that allowed us to borrow up to 65% of the value of our home.

Some of us are already feeling the pinch of owing too much debt, with almost a 10% increase in the number of consumer insolvencies compared to last year, according to the latest figures from the Office of the Superintendent of Bankruptcy Canada.

“Personal insolvency growth continues as a result of consumer credit stress, individuals and families are struggling with overwhelming debts,” says Chantal Gingras, Chair of the Canadian Association of Insolvency and Restructuring Professionals (CAIRP).

And it seems we’re not slowing down. Despite years of counselling from the Bank of Canada against rising debt levels, many Canadians still aren’t lightening their debt load even though interest rates are rising and borrowing costs are climbing.

“Oh, we can manage our payments, we’re all good,” we keep saying. At least for now you can, but all that can change with a few unexpected calamities.

“If there is a period of slow economic growth in the future, Canadians could face job losses or decreased income putting them in an even worse position to manage their increasing debt levels,” says Scott Hannah, the Founder of the Credit Counselling Society.

Look, we all want to have a new car, a new home, dine in fine restaurants and enjoy luxury vacations, and grand shopping sprees. Who doesn’t, right? It’s great if we can afford them, there’s absolutely nothing wrong with spending on these things — as long as we don’t swim in debt for them.

But how exactly do you figure out that you’re close to being in over your head with too much debt? Let’s take a look at what too much debt looks like:

What Too Much Debt Looks Like to Lenders

In general, banks and other lenders look at your Total Debt Service Ratio, or TDSR, which is the portion of your income needed to cover all of your debts. Lenders will look at all of your monthly debt payments plus heating costs and taxes if you own your house and divide this by your gross income. Standard TDSR should not be higher than 40% of your income. So when you add up all your monthly credit card payments (minimum or partial payments each month), line of credit payment, car payment, mortgage payment, alimony and payments for heat and taxes, the total amount of all of these should not be more than 40% of your monthly gross income (which is your income before taxes). In other words, banks will not lend you money if your TDSR exceeds 40%.

If you are applying for a mortgage, lenders will also take into consideration your Gross Debt Servicing Ratio or GDSR in addition to your TDSR. GDSR is the portion of your gross income that goes towards paying all of your monthly housing costs, which can include principal mortgage payment, interest, property taxes, and heating costs (PITH) plus+ 50% of condo fees if applicable. The standard is less than 32%. Lenders will not give you a mortgage if your GDSR is more than 32%.

What Too Much Debt Looks Like to Your Budget

First order of business, ask yourself: How much do you need to live a lifestyle that is comfortable and acceptable to you? For this, you need to figure out the amount of money you need to support your way of living now as well as allow you to save for the future.

Identify all your sources of income – take home pay and extra income from a side job.

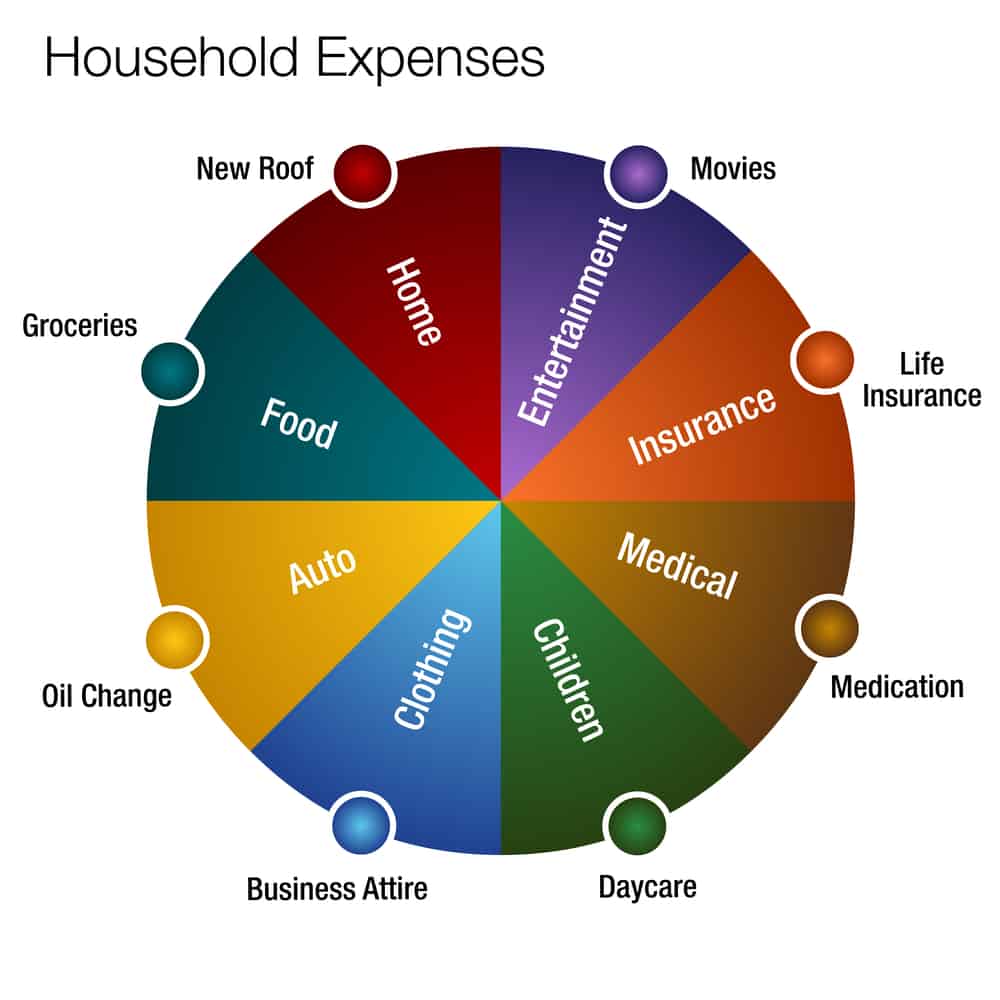

Calculate the cost of living expenses (also called non-discretionary expenses) – jot down every cent you spend that you must pay each month, including food, rent, mortgage, utilities, credit card payments, car loans, insurance payments, taxes and personal necessities

Calculate financial goals – amount for investing or saving after paying all non-discretionary expenses

Calculate discretionary expenses – amount for spending on non-essential items, restaurant dining, vacation expenses, luxury clothes, entertainment, etc.

Obviously, if you have no money remaining after paying bills then your income cannot support your financial goals as well as your unnecessary spending habits. If you must incur debt to pay for discretionary expenses, then you have too much debt.

If you routinely carry on debt, use your credit cards to pay for grocery bills or other utilities, constantly overdrawing your line of credit account or go overboard with an overdraft, and always have to take on a payday loan or a consolidation loan, these are warning signs that your budget is too tight and that you may have too much debt and may be heading for trouble.

Budgeting is really one of the smartest things you can do to keep yourself from accumulating too much debt. A budget will help you manage your finances and help you see how much debt you can afford to make payments on based on your income each month. It can really help you to live within your means and not spend more than you earn.

Too much debt can mean different things to different people, but the key is to figure out the amount of debt you have to how much money you make a month. The general rule is that your debt level should not be more than 40% of your monthly income.

Use the guidelines:

Total Debt Service Ratio (TDSR) over 40% = too much debt

Gross Debt Service Ratio (GDSR) over 32% = too much debt

Personal budget – more than half of your income is used to pay your debts = too much debt

Ideally, the less debt you owe, the better off you are. A little bit of debt is unavoidable, even necessary, to help you meet financial goals. Always live with a spending plan so you can manage debt payments efficiently and avoid going into too much debt. If your budget is too tight, you are close to the edge of having too much debt. When a financial crisis hits you, your budget is wiped out and you’ll be forced to take on debt for everything you need to pay for. Tap on all the resources you can to get back in control right away before your debt levels get out of hand.

When your debt and bills exceed your income, needless to say, you’re in a debt crisis and you need to make a committed decision to get out of debt without delay. Check out your debt solutions and options here.

How to Save Money When You Are Broke

Is it possible to save money when you are broke and a big chunk of your income goes towards paying monthly expenses and dealing with debt? Saving money even while you are getting out of debt and have a low income should not be as difficult as many people think. Of course, you will need to make a few changes to how you currently do things, like following a strict budget and really making an effort to live within your means, but those changes don’t have to be overly radical in that you deprive your family and yourself too much that you can no longer live a decent lifestyle.

Here are some strategies to help you do this the right way:

Make a budget

To be able to save money when you are broke, you will definitely need to start paying attention to how you spend every dollar because the little things that you do day-to-day matter a lot! It’s all about taking control of your money and your financial situation and in order to have that power you need to know where each penny goes. When you are aware of this, it will enable you to make the right decisions on how you spend. Creating a monthly budget is the single most effective way to help you keep track of your spending and savings. Budgeting and savings apps will make this task easy for you as they can help you manage your finances on the go direct from your smartphone. No need to log in anywhere else or bring out a pen and paper. Some popular apps you can try out are: Mint.com, Receipts, Debt Minder, Debt Manager, iExpenselt, and many others. Choose one that best suits your budgeting and money management needs, and really be disciplined to make it work for you. Set aside the time each day or week to look at your app and keep an eye on your spending activities, this way you will really see results.

Make adjustments on household expenses

Once you have your budget set up, you can get to work on making some tweaks to your lifestyle. First thing to look at is if you are spending your money on what’s necessary like grocery, water bill, electric bill, gas, etc. Then, make adjustments and cut back on some things.

- Reduce your water usage. Small things like taking shorter showers, installing low-flow faucets and shower-heads, installing a rain barrel and other unwasteful ways will not only bring lots of savings on your water bill but you’re also helping to save the environment.

- Look for ways to lower your energy usage every day. Things like lowering your thermostat, running full loads in the dishwasher and clothes washer, opening drapes and blinds during the day to use up solar energy are some sensible options to conserve energy and save cost.

- Find practical ways to save money on groceries. One of the best ways to cut spending on food is to eat out less. Start making little changes like cooking your own meals, bringing your own lunch, making your own coffee everyday instead of dining out at cafes and restaurants and you will find that you can easily save thousands of dollars on your food budget per year.

- Let go of the cable tv and cancel other subscriptions that are not really needed, like your magazine subscription or your gym membership.

- Save on gas bill and transportation costs. This is also a significant expense for most Canadian households, including your own. The cost of gas is expensive and public transport is not free, so cutting down on this expense will make a huge difference on the budget. Consider carpooling or walking or biking, maybe you can buy cheaper gas in your area – use free apps like GasBuddy, Gas Guru or Waze to help you find cheap gas, or try talking to your HR department if they have any programs available that will subsidize the cost of gas expenses or public transportation.

- Quit your bad habits, like smoking cigarettes and drinking alcohol. A smoking and drinking habit is extremely costly. A pack of cigarettes in Ontario, for example, can be from $18.37 a pack. That means you could be spending as much as $569 per month if you smoke a pack a day. To give you a clearer perspective of how much your bad habits costs you, try using this expense calculator to see how much money you could be spending on something else.

- Cut back on shopping. You will pay a lot less, for example, if you shop at thrift stores. You can find a lot of stuff, clothes, appliances, odd items, that have never been used, worn, or even opened. Another great way to save money on shopping is to avail of cash backs where you can get a little of your money back on purchases you make. When you shop at retailers like Amazon, Target, and Starbucks, for example, they can let you earn points for each dollar you spend and also get exclusive coupons and deals.

- Find ways to pay off your mortgage faster. As a rule of thumb, your housing expense should not take up more than 30% of your income. If this is not the case with your household, then you may need to refinance for a lower mortgage rate. Getting that interest rate down will save you money and enable you to use that money to pay off your mortgage faster so you can get out of debt more quickly.

It’s these little stuff in your daily habits that can add up. However, you have to find ways to cut back, even eliminate some things, especially when you are broke and have debts to pay off. If you watch closely what you spend, you will be surprised how much you can save monthly.

Make sure you have enough savings

Regardless of your situation, you have to start an emergency savings account. It is very important to have a little bit of money saved up even when you are paying off a lot of debts. You can start small and maintain that amount until you have a bit of wiggle room. The aim is to save and make sure you have some cash to pay for emergency expenses when they arise. Remember, this money is for emergencies only, so keep it someplace where you can easily access it when you need it but not easily within reach so you won’t be able to spend it spontaneously.

I challenge you to take on a couple of these money saving strategies and maybe find other ways that you can be saving money on a daily basis and then really have the commitment to apply them in your daily life and make them work. You will find that little by little, slowly but surely, you are able to get out of debt faster, your savings account balance will be growing, and you’ll see all your financial dreams come true in no time at all.

Consumer Proposals In Mississauga- What You Need To Know

In this video, Sean Killen, President of Richard Killen & Associates Ltd., answers frequently-asked questions on consumer proposals and bankruptcies in Mississauga.

Do you see more consumer proposals or bankruptcies in Mississauga?

Over the history of our office in Mississauga, there are about 60% consumer proposals. People coming into us don’t even want to hear anything about bankruptcy although we are required to go through it with them because it is part of the legalities.

Is there a minimum amount of debt required to be eligible for a consumer proposal or bankruptcy in Ontario?

There is a minimum under the law. The minimum would be $1,000. The law says you cannot declare yourself insolvent unless you meet the criteria of owing more than $1,000.

What’s the average duration of a proposal?

Consumer proposals are designed to be over a 5-year period because that’s the restriction that the law puts. They are not allowed to go beyond five years. However, the person has the freedom and the ability to shorten the term if they want with no interest, no penalties and no restrictions. Although most proposals are designed over five years, they end up paying out right around the four-year mark. Most of the time, after they get over about two and a half years, they start seeing the light at the end of the tunnel and want to pay it off faster. Therefore, they start ramping up their payments a little bit. Furthermore, they have a chance to get reorganized and start realizing the value in getting things out of the way.

What’s the status of the debt during a consumer proposal?

All the debts still exist. The creditors just agreed to sit back and see whether or not you can satisfy the agreement that was made. Ultimately, the final signatures are in place verifying that you have met the terms of your agreement. The debt still exists and can still blow back on you. Every once in a while, we’ll have a file that does that but very rarely will a file ever get past the halfway mark and then not complete. Most files that don’t make it fail in the first year and that’s just because everybody wants to do it but overextends themselves. They don’t properly accommodate to what the reality of their expenses really are. They think they can find money, they can cut back, and they can make this work just so that they can avoid bankruptcy.

If I go bankrupt, can I get a mortgage?

Getting a mortgage is still difficult because your debts still exist. Getting a mortgage renewal is not a problem. We always advise you to look for automatic renewal. You are already in the mortgage and you are already making payments. As long as you have never missed any payments, they’re just going to renew you, anyway.

If I Go Bankrupt or do a consumer proposal, can I get a car loan?

It’s easier to get a car loan while you’re in a proposal as opposed to bankruptcy. However, most lenders don’t really care whether you’re in a bankruptcy or a proposal. They’re just happy that you’re not dealing with outstanding debts and have creditors looming over you. However, you will always have to pay for it with higher interest rates to make sure they make enough money to cover their risks. They’re happy to lend it to you. Their money is in the car and not in you, necessarily. In general consumer proposals in Mississauga are significantly more popular than bankruptcies.

Alternatives To Bankruptcy In The Greater Toronto Area

In this video, Richard Killen, a Licensed Insolvency Trustee in bankruptcy with offices in Durham, and the Greater Toronto area talks about alternatives to bankruptcy for an insolvent person.

People come to see us and the very first thing that comes out of their mouth is “I don’t want to go bankrupt.”

Therefore, alternatives to bankruptcy is foremost in people’s minds when they come to see us.

Bankruptcy is a tool. It is a solution to a problem that needs some kind of a resolution and it’s there to be used as such. When we talk about alternatives to bankruptcy, we look at the idea that if you have financial problems, you ask yourself as to what degree do I have these problems and you start by thinking to define the level of the problem to be able to use bankruptcy as a solution.

There is an insolvent person. Being insolvent, in a legal definition, means being unable to pay creditors at least in the minimum way that they demanded to be paid. If a person is not insolvent, he or she can’t do a bankruptcy because there are other options that are open to them.

When people come to see us, they have already sought other ways of dealing with their problems. They have talked to relatives, friends, banks, and a few people. They are looking for the magic bullet that’s going to solve their problem. If they are insolvent and if they are not able to deal with creditors, they have five options open to them. Option number one, which is often tried by people, is to consolidate debts in to a consolidation loan.

One reason they may have problems is that they have so many creditors and they just can’t keep paying all of them. They have no means to pay for them. But if they approached a bank or a finance company, they might be able to get a loan and pull all those debts into one. Very often in that situation, the one payment you have to make for the bank is going to be less than the total payment of all the miscellaneous payments that you have to make previously. However, if you have trouble and you are insolvent, and chances are you are behind with your payments, therefore you will not be able to get a consolidation loan from a lender.

Assuming that a consolidation loan Toronto won’t work, there is another option. The option would be to talk to the creditors to find some kind of compromise. You must to do this with each one of the creditors because if one or two of them don’t go along with you or with the other creditors, what they can do if you are behind your payment is that they can mess up your plans by suing you.

Between the consolidation and the renegotiation with the creditors, we call these things the commercial options because you don’t need a guy to help you with that. What you need is to find a lender or you need to make a deal with your lender. However, if they don’t work, then you’re probably going to look at the legal options that the trustee can provide.

That’s why people come to see us. They know that the first two options that I was talking about are no longer available, so they come to the trustee. The trustee will offer them and provide them options. One of them is the proposal which is an alternative to bankruptcy.

When you’re doing a proposal, you are getting all the protection that the bankruptcy process offers you, such as putting a stop to creditor pursuits and creditor harassment. If you are to do a proposal, which the vast majority are now calling a consumer proposal, you are going to essentially make a deal with your creditors. Instead of having a one-on-one with them like in Option Two that I have mentioned, you can make a deal with your creditor all in one. The negotiations are with the group and are usually done by a trustee. Therefore, there’s quite a load off your mind and off your stress level.

If the creditors agree, then you have taken all those various debts and consolidated it into one payment every month. You make the payment to the trustee and the trustee distributes the money to the creditors in accordance with whatever arrangement that you and the creditors agreed on.

Not everyone can make a proposal. Some people don’t have the means to do it. They don’t really have anything to offer. But it’s surprising that some people come here and when they have heard the proposal, they feel that they don’t have the means to do it. They do not believe they can offer anything that the creditors would accept and in many cases they do.

The creditors have decided that it’s better to go on to a proposal than to force people to end up to bankruptcy where very often, creditors get nothing or next to nothing.

Are there alternatives to bankruptcy? Yes. There are a lot of alternatives. Most people have looked at them to some extent before they come to see us. When they come to see us, we are going to make sure that they do know about all the other options. Quite frankly, if somebody can avoid bankruptcy as far as I am concerned, that is a good move.

2018 INSOLVENCY & RESTRUCTURING EXCHANGE

On October 26, 2018, Richard Killen, Bonnie Bryan and Michele Meitz attended the 3rd annual 2018 Insolvency & Restructuring Exchange in Toronto.

This is the Canadian Association of Insolvency and Restructuring Professionals (CAIRP) largest one day event of 2018. Almost ninety percent of Licensed Insolvency Trustees, licensed under Canada’s Bankruptcy and Insolvency Act are members of CAIRP.

CAIRP was created as a non-profit corporation in 1979 to advocate a fair, transparent and effective system of insolvency/restructuring administration throughout Canada.

This event is the best place for professionals from consumer and corporate restructuring practices to network and learn together.

We were glad to get the opportunity to meet and hear from fellow CAIRP members, lawyers, members of the judiciary, lenders and government officials as part of the days events.

A Person in Toronto Asks -Should I Go Bankrupt?

In this video, Richard Killen, a Licensed Insolvency Trustee in bankruptcy with offices across Toronto answers the question.

I don’t know how many times I have been asked by somebody during the course of the free consultation we provide to consumers at the beginning. What do you think, should I go bankrupt?

My answer is always the same for people. Its not up to me to tell you to go bankrupt.

Bankruptcy is a personal decision. What might work for one person, might not work for another person. Although what you can get from a trustee is a good idea of what is going to happen if you do a bankruptcy opposed to a consumer proposal.

So to answer the question, should I go bankrupt? My answer is you need to decide that.

What happens to my tax refund in a bankruptcy or consumer proposal in Brampton?

In this video, Richard Killen, a Licensed Insolvency Trustee in Ontario with offices in Durham region (Pickering & Oshawa) talks about whether a person’s income tax debt can be included in a personal bankruptcy in Ontario.

Something that comes as a big surprise to a lot of people is when they find out an income tax debt, an ordinary income tax debt is something that is dischargeable in a bankruptcy or can be taken care of in a consumer proposal. The people of Durham or people from across the Greater Toronto Area ask me that question numerous times. It is not a strange thing as ordinary income tax debt is treated as a debt.

There is nothing special about the fact it is a debt owed to the government. A debt to the government is not anything special in a bankruptcy situation. Therefore, in a bankruptcy in Durham or anywhere in Ontario, a tax debt is dischargeable.

If you are behind on your taxes or are have other debt problems, consider talking to one of our trustees and debt experts. We can help you review all your options for debt relief.

Contact our Durham office us for a fresh start at (905) 420-6565